Starting an ecommerce business in the USA in 2025 is exciting—but to make it real, you must first register your ecommerce business legally in the USA. This step-by-step guide explains how to do it the right way.

1. Choose the Right Business Structure

Before anything else, decide how you want to structure your business. The three most common options are:

- Sole Proprietorship – Easy to start but no liability protection

- Limited Liability Company (LLC) – Protects your personal assets and offers flexibility

- Corporation (C Corp or S Corp) – Good for scaling or raising fundsBefore choosing a structure, you might want to explore this ecommerce business plan example for beginners to align your goals with your setup.

Why Your Business Structure Matters

Your business structure affects your:

- Taxes

- Legal protection

- Funding opportunities

- Business credibility

If you’re just starting, it’s worth researching or consulting a legal advisor before choosing.

2. Register Your Business Name

Once you’ve chosen your structure, it’s time to register your ecommerce business in the USA officially. This step not only legalizes your business identity but also helps build credibility with customers and partners.

Here’s what you need to do:

- Make sure it’s available in your state

- File a DBA (“Doing Business As”) if needed

- Check domain availability too

Tips for choosing your business name:

-

It should be unique and easy to spell

-

Relevant to your ecommerce niche

-

Free from trademarks (check USPTO database)

Once confirmed, use your state’s Secretary of State website to officially register your ecommerce business name.

3. Apply for an EIN (Employer Identification Number)

An EIN is like a Social Security Number for your business. You need it to:

- Open a business bank account

- File federal taxes

- Hire employees

- Work with suppliers and payment processors

You can get your EIN for free from the IRS website. It’s fast and easy.

4. Get State Licenses & Permits

Depending on your location and what you sell, you may need:

- A Sales Tax Permit

- A Home Occupation Permit (if working from home)

- Industry-specific licenses (e.g., cosmetics, supplements, food, alcohol)

Each state and city may have different rules. Always check your local government’s website.

5. Open a Business Bank Account

To keep your finances legal and separate:

- Open a business checking account

- Use it only for business income and expenses

- Get a business debit or credit card

This keeps your books clean and builds your business credit history.

6. Understand Your Tax Obligations

Ecommerce taxes can be tricky but are essential:

- Federal Income Tax

- State Income Tax (if applicable)

- Sales Tax (varies by state)

- Self-Employment Tax

Most ecommerce businesses need to collect and remit sales tax in states where they have a “nexus.” Platforms like Shopify or WooCommerce can help automate sales tax collection.

Pro Tip:

Use accounting software or consult an accountant to stay on track and avoid penalties.

7. Set Up Business Insurance

Though not always required, business insurance protects you from risk. Common options include:

- General Liability Insurance

- Product Liability Insurance

- Home-Based Business Insurance

Insurance gives peace of mind and may be required by platforms or partners.

8. Create Essential Legal Documents

Your ecommerce store needs legal pages to protect you and build customer trust:

- Privacy Policy

- Terms and Conditions

- Return & Refund Policy

- Shipping Policy

These documents are especially important for compliance (like GDPR and CCPA) and transparency.

9. Keep Your Business Compliant

After initial registration, stay legally compliant by:

- Filing annual reports (LLCs and Corporations)

- Renewing licenses on time

- Keeping accurate records

- Monitoring changes in ecommerce regulations

Failing to stay compliant can result in fines or even losing your business license.

10. Protect Your Brand

Consider trademarking your brand name or logo once your business starts gaining traction. This gives you legal ownership and helps protect your identity from copycats.

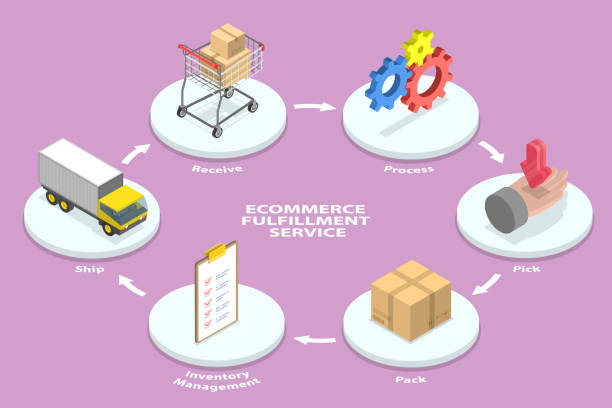

[Insert 1 image: Infographic showing “10 Steps to Legally Register Your Ecommerce Business in the USA”]

[Image Alt Text: Legal steps to start an ecommerce business in the USA in 2025]

Internal Links:

[Link this text → Ecommerce Business Plan Example for Beginners in 2025]

[Link this text → Choose the Right Ecommerce Product in 2025 (Guide)]

Final Thoughts

When you register your ecommerce business legally in the USA, you’re building long-term trust and compliance. It’s not just about legal compliance — it’s about creating a real, trustworthy brand that customers can rely on. Take it step by step, and don’t rush the process. You’ll thank yourself later.

Call to Action:

Still brainstorming your niche? Here’s how to choose the right ecommerce product for long-term success.