Getting paid is just as important as making the sale. If you’re building your first store, setting up the right payment system can feel overwhelming. This guide will help you _simplify the entire ecommerce payment setup USA for beginners 2025 process — even if you’re starting from scratch.

From payment gateways to compliance, you’ll get clear answers so you can launch and get paid without tech headaches. Whether you’re selling physical products or digital downloads, a secure and smooth online payment setup is non-negotiable. In the USA, shoppers expect fast, flexible checkout experiences with multiple payment options. For beginners, it’s crucial to balance simplicity with security — choosing tools that are easy to set up while still meeting legal and technical requirements. This guide is designed to help you build a trusted foundation from Day 1.

💳 Why Payment Setup Is Critical for Ecommerce Success

Your ecommerce payment setup influences your entire customer journey. A slow, complicated, or untrustworthy checkout can ruin your chances of converting visitors into buyers.

Key reasons to optimize:

-

Builds trust and credibility

-

Improves mobile checkout performance

-

Reduces cart abandonment

-

Ensures PCI compliance in the US

🛠 Step-by-Step Ecommerce Payment Setup (USA, 2025 Edition)

✅ 1. Choose a Platform That Supports Fast Payment Integration

Select a beginner-friendly ecommerce platform like:

-

Shopify – Built-in payments + fast onboarding

-

WooCommerce – Ideal for WordPress users

-

Wix – Great for small product stores

📌 Need help choosing your product first?

👉 Read: Choose the Right Ecommerce Product in 2025 (Guide)

✅ 2. Select a Reliable USA Payment Gateway

Popular gateways in the United States for 2025:

-

Stripe – Clean API, supports Apple Pay

-

PayPal – Trusted and widely used

-

Square – Ideal for online + POS sales

-

Authorize.Net – Great for advanced fraud protection

Pro Tip: Make sure the gateway supports mobile wallets, Buy Now Pay Later, and international currencies.

✅ 3. Set Up a Merchant Account (If Needed)

For Stripe and PayPal, no separate merchant account is required. For Authorize.Net, you may need to create one.

Stripe is still the top beginner-friendly choice for 2025.

✅ 4. Secure Your Store with PCI Compliance

PCI-DSS compliance is mandatory for U.S. stores. To stay compliant:

-

Install SSL (use Let’s Encrypt for free)

-

Don’t store customer card data

-

Use tokenized gateways

-

Use security-verified payment plugins

🔗 Official PCI Compliance Resource: Official PCI Compliance Guide (Dofollow)

✅ 5. Add Checkout Trust Signals

Conversion-boosting trust elements:

-

Padlock icon on checkout URL

-

“Secure Checkout” text

-

Trusted badge logos (Stripe, PayPal, Norton, etc.)

-

Clear return & refund policies

✅ 6. Test Your Payment System

Test everything before going live:

-

Try real and sandbox orders

-

Test on mobile & desktop

-

Confirm order and confirmation emails

-

Check failed transaction handling

🔥 Top Payment Options to Offer in 2025

In 2025, offering diverse and customer-friendly payment methods is no longer optional — it’s a competitive edge. Shoppers want options that match their lifestyle: credit cards, digital wallets, and even Buy Now Pay Later services. By integrating the best ecommerce payment solutions early, you create a frictionless checkout that encourages repeat business and builds long-term trust with your audience. Make sure to support:

-

✅ Visa, MasterCard, AmEx

-

✅ Apple Pay, Google Pay

-

✅ PayPal

-

✅ Klarna, Afterpay (BNPL options)

More flexibility = more conversions.

⚠️ Mistakes to Avoid During Payment Setup

-

❌ Not supporting mobile payment methods

-

❌ Ignoring PCI and security measures

-

❌ Not comparing transaction fees

-

❌ Forgetting to test cross-device experience

📌 Starting your store legally?

👉 Read: How to Start an E-commerce Business in the USA (2025 Guide)

✅ Visual Checklist: Ecommerce Payment Setup (2025)

| ✅ Step | Action | Tools |

|---|---|---|

| 1️⃣ | Pick your ecommerce platform | Shopify, WooCommerce |

| 2️⃣ | Choose a gateway | Stripe, PayPal, Square |

| 3️⃣ | Link your merchant account | If required |

| 4️⃣ | Ensure PCI compliance | SSL, tokenization, plugins |

| 5️⃣ | Add trust elements to checkout | Secure icons, reviews |

| 6️⃣ | Enable mobile wallets + BNPL | Apple Pay, Klarna |

| 7️⃣ | Test payment flow | Sandbox/live orders |

| 8️⃣ | Monitor failed payments + track dashboard notifications | Gateway dashboard |

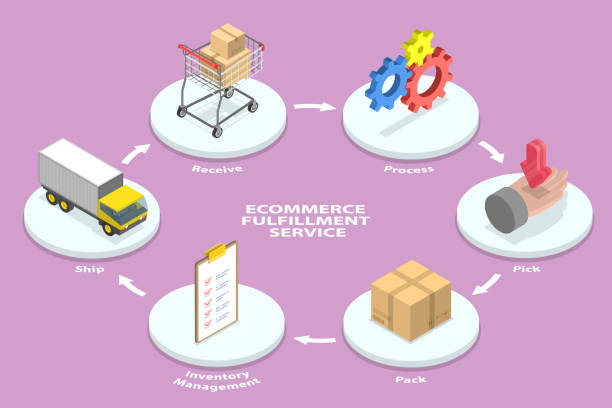

📦 What’s Next After Setting Up Payments?

Once you’re ready to accept payments, you’ll need to ship orders smoothly and professionally. Learn how to handle logistics, rates, and delivery expectations.

👉 [Coming soon: Ecommerce Shipping and Fulfillment Guide 2025] (anchor for next content)

🏁 Final Thoughts

A strong ecommerce payment setup USA for beginners 2025 can be the difference between a store that struggles and a store that scales.

By choosing the right gateway, ensuring compliance, and delivering a seamless checkout experience — you’ll not only get paid,